Ira distribution tax calculator

Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022. Use the Tables in Appendix B.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

. Save for Retirement by Accessing Fidelitys Range of Investment Options. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

For example if you have a 100000 traditional IRA and have made 15000 in nondeductible contributions over the years the nondeductible portion is 015. This means 36585 percent of your distribution counts as taxable income in this example. Build Your Future With A Firm That Has 85 Years Of Investing Experience.

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Compare 2022s Best Gold IRAs from Top Providers. Stock Non-constant Growth Calculator.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. State income tax rate 0 7 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Retirement Plan Withdrawal Calculator Definitions Amount to withdraw The amount. This tool is intended to show the tax treatment of distributions from a Roth IRA.

Roth IRA Distribution Tool. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

Using the example divide 15000 by 41000 to get 036585. Reviews Trusted by Over 20000000. Weighted Average Cost of Capital Calculator.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Starting the year you turn age 70-12. Calculate the required minimum distribution from an inherited IRA.

To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on. How to Fill Out W-4. This calculator has been updated to reflect the new.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. If you want to simply take your inherited money right now and pay taxes you can. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Holding Period Return Calculator. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Ad Use This Calculator to Determine Your Required Minimum Distribution.

Ad You Can Open A TIAA IRA That Fits Your Needs Potentially Save With Tax Benefits. Property Tax Calculator. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

But if you want to defer taxes as long as possible there are certain distribution requirements with which you. The RMD for each year is calculated by dividing the IRA account balance as of December 31 of the prior year by the applicable distribution period or life expectancy. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. That is it will show which amounts will be subject to ordinary income tax andor.

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Ira Withdrawal Calculator Factory Sale 52 Off Rikk Hi Is

Traditional Vs Roth Ira Calculator

Retirement Income Calculator Faq

Roth Ira Calculator Roth Ira Contribution

Download Traditional Ira Calculator Excel Template Exceldatapro

Taxable Social Security Calculator

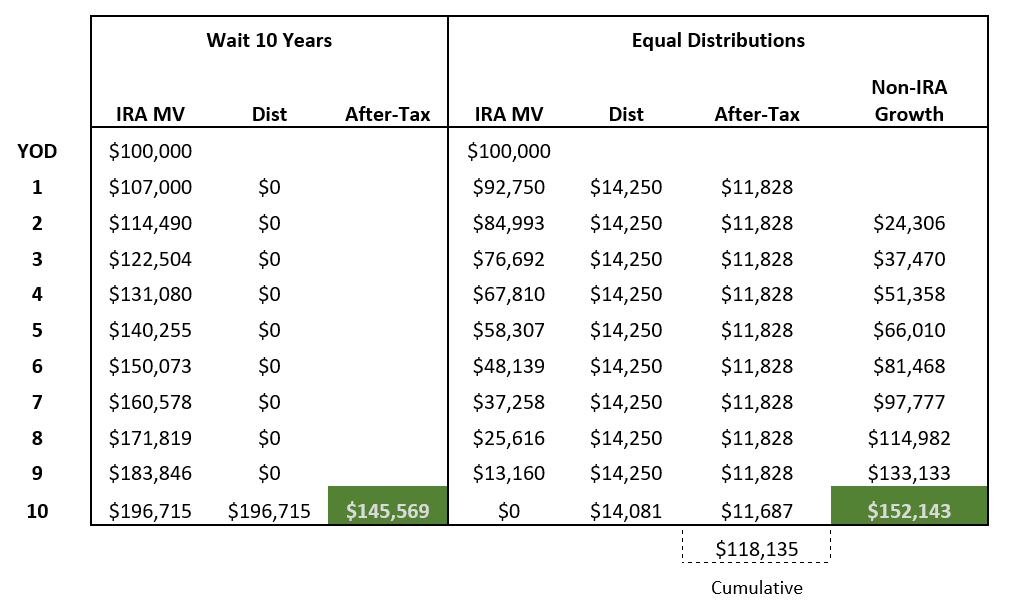

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Ira Calculator Excel Template Exceldatapro

Retirement Withdrawal Calculator For Excel

Understanding The Secure Act Managing The 10 Year Rule Financial Planning Insights Manning Napier

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Ira Money Probably The Best 50 Fresh Ideas For Coloring Iconmaker Info

How To Evaluate Your Current Vs Future Marginal Tax Rate

Tax Calculator Estimate Your Income Tax For 2022 Free