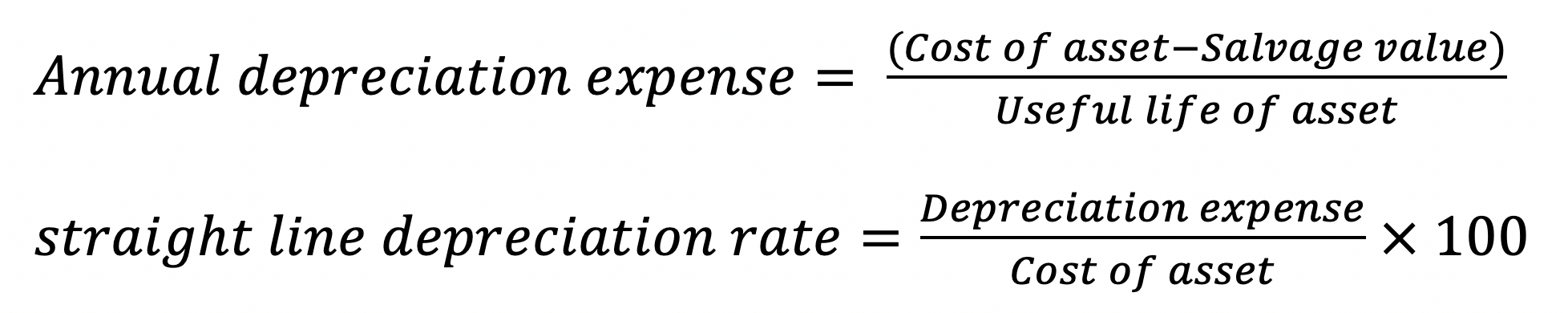

Depreciation value is calculated by the formula

In regards to depreciation salvage value is the estimated worth of an asset at the end of its useful life. A formula for Depreciation expense under.

Depreciation Formula Examples With Excel Template

If the salvage value of an asset is known the cost of the asset can.

. Straight line depreciation is the most commonly used and straightforward depreciation method for allocating the cost of a capital asset. 25000 - 50050000 x 5000 2450. It is calculated by simply dividing.

How would you calculate a partial year of depreciation using. It is determined by multiplying the book value of the asset by the straight-line methods rate of depreciation and 2 read more method to calculate the tanks depreciation expense. Depreciation Calculator Calculate the depreciation of an asset using the straight line declining balance double declining balance or sum-of-the-years digits method.

2 x Original cost of the asset Resale value Estimated asset lifespan Declining balance per year Example. The straight-line depreciation method is the easiest to calculate and the annual depreciation amount original net value of assets-estimated residual value service life. Asset cost - salvage valueestimated units over assets life x actual units made.

Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. The concerned asset is depreciated with an unequal amount every year as the depreciation is charged to the book value and not to the cost of the asset. Depreciation per year Asset Cost - Salvage Value Useful life Declining Balance Depreciation Method For specific assets the newer they are the faster they.

The Excel SYD function returns the sum-of-years depreciation for an asset in a given periodThe calculated depreciation is based on initial asset cost salvage value and the number of periods. Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. Depreciation formula for the double-declining balance method.

Depreciation Percentage - The depreciation percentage in year 1. What is the formula for each depreciation method. It is also called the.

Value per Year 10 200000 50000 D. It is the initial book value. Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States.

Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Depreciation Amount for year one 1800. The closing value for year one is calculated by subtracting the.

List the three methods to account for depreciation expenses. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life. Depreciation is calculated by proportionating Depreciable cost in Produced units divided by Budgeted production capacity.

Depreciation 2 Straight line depreciation percent book value at the beginning of the accounting period Book value Cost of the asset accumulated depreciation Accumulated. A company buys a new lorry for 30000 which. It is calculated by simply.

Depreciation Amount for year one 10000 1000 x 20. Calculating Depreciation Using the Units of Production Method. Periodic Depreciation Expense Beginning book value x Rate of depreciation.

This is calculated by taking the. The following is the formula.

Depreciation And Book Value Calculations Youtube

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Formula Examples With Excel Template

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Straight Line Depreciation Formula And Calculation Excel Template

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

How To Use The Excel Db Function Exceljet

Aasaan Io Blog